Funding for the state (often referred to as the nonfederal) share of Medicaid comes from a variety of sources. By law, at least 40 percent must be financed by the state and up to 60 percent may come from local governments. In state fiscal year (SFY) 2012, 69 percent of funds came from state general revenues, 16 percent from local governments (including intergovernmental transfers and certified public expenditures), 10 percent from health care-related taxes, and 5 percent from other sources (see Government Accountability Office 2014). Given this diversity of nonfederal funding sources, MACPAC typically reports Medicaid’s share of state-funded budgets counting all state funds, rather than state general funds alone.

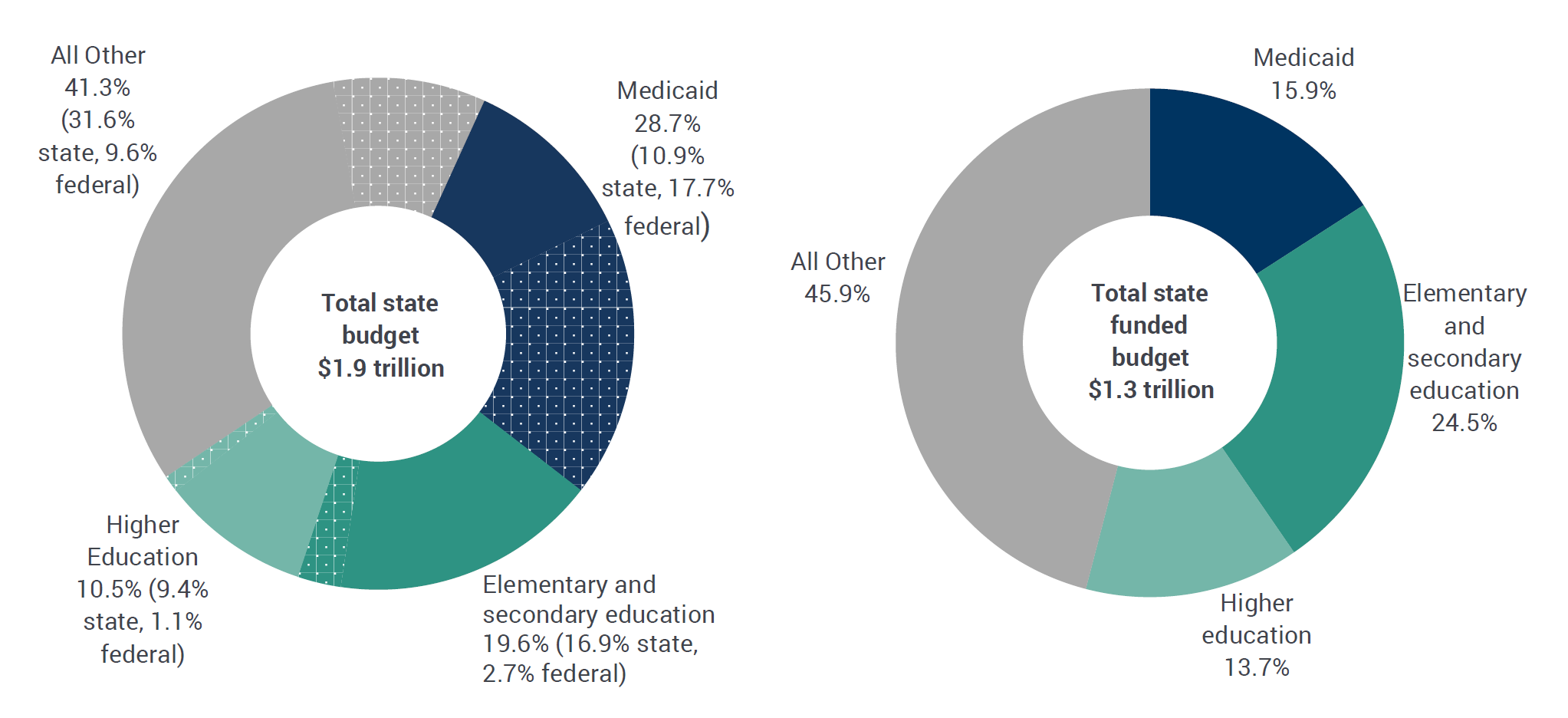

Medicaid’s share of state budgets varies across states and differs substantially depending on how it is measured. Looking at spending from total state budgets for state fiscal year SFY 2016, including funds from all state and federal sources:

- Medicaid accounted for 28.7 percent of spending from all sources (Figure 1).

- Federal funding provides the majority of Medicaid expenditures.

Looking only at the state-funded portion of state budgets for SFY 2015, which states must finance on their own through taxes and other means:

- Medicaid accounted for 19.6 percent of spending from state general funds, which are raised through income, sales, and other broad-based state taxes (Figure 2).

- The program accounted for 15.9 percent of spending from state general funds and other non-federal amounts that are not a part of general funds, such as provider taxes levied for Medicaid purposes (Figures 1 and 2).

FIGURE 1: Distribution of Medicaid, Education, and All Other Spending from Total State Budgets versus State-Funded State Budgets, SFY 2016

Notes: SFY is state fiscal year. Total state budgets include all state (solid segments) and federal funds (dotted segments). State-funded state budgets include all non-federal funds, and consist of state general funds (expenditures from revenues raised through income, sales, and other broad-based state taxes); other state funds (expenditures from revenue sources that are restricted by law for particular government functions or activities, which for Medicaid includes provider taxes and local funds); and bonds (expenditures from the sale of bonds, generally for capital projects).

Source: MACPAC analysis of data in National Association of State Budget Officers 2017.

Medicaid spending is often compared to education spending, another major state expenditure, but the picture is incomplete when looking at state budgets alone. Funding for education is generally a state and local responsibility, but the local portion is generally not reflected in state budgets. In contrast, Medicaid is a shared responsibility between the federal government and states, and most of the program’s funding flows through state budgets. As a result, when combined state and local budgets are examined (rather than state budgets alone), education’s share of spending remains similar and Medicaid’s becomes smaller. For example, Medicaid’s share of spending by state governments (from all revenue sources, including federal dollars) was over 25 percent and education’s share was above 30 percent in SFY 2016 (Figure 1). In comparison, when examining amounts that include spending by state and local governments, Medicaid’s share is smaller (an estimated 16 percent in SFY 2015) and education’s share is about the same (37 percent) (MACPAC analysis of data in Barnett et al. 2014).1

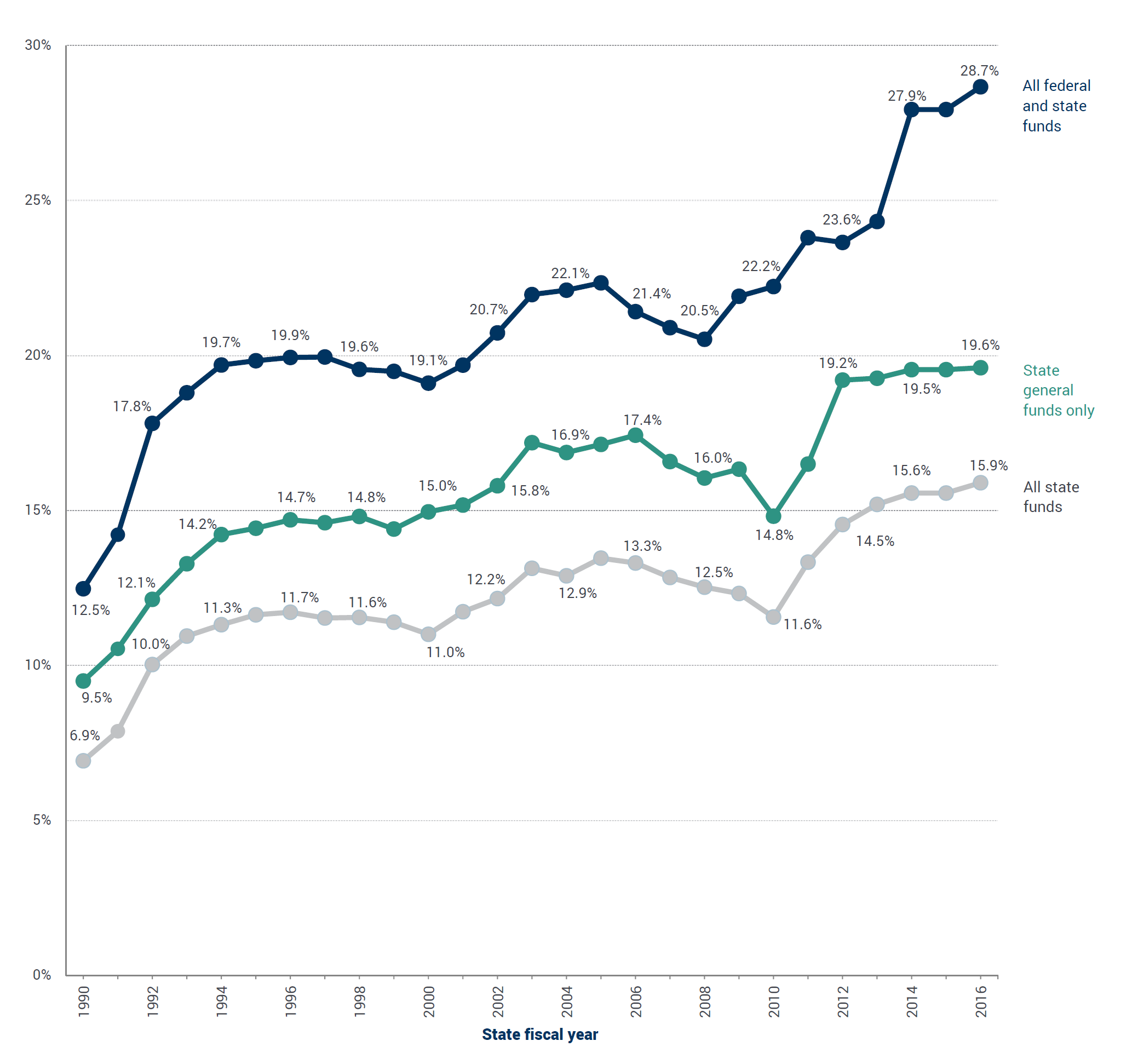

Between SFY 1989 and 2008, Medicaid’s share of state budgets reflected similar trends regardless of whether federal funds were counted (Figure 2). In SFYs 2009 and 2010, however, the program’s share of state-funded budgets (excluding federal funds) remained stable or dropped, while its share of total state budgets (including federal funds) continued to increase. This divergence coincided with a temporary increase in Medicaid FMAPs, which effectively allowed states to maintain their programs with a smaller state contribution. The temporary increase, part of the American Recovery and Reinvestment Act of 2009 (P.L. 111-5) and the Education, Jobs, and Medicaid Assistance Act of 2010 (P.L. 111-226), ran from the first quarter of FY 2009 through the third quarter of FY 2011, and was intended to provide states with fiscal relief during the economic downturn occurring at the time. By SFY 2011, Medicaid’s share of state-funded budgets had returned to previous levels.

FIGURE 2: Medicaid’s Share of State Budgets Including and Excluding Federal Funds, SFYs 1990-2016

Notes: SFY is state fiscal year. Amounts shown here reflect the most recent information available in cases where data for a given year were published and then updated in a subsequent report.

Notes: SFY is state fiscal year. Amounts shown here reflect the most recent information available in cases where data for a given year were published and then updated in a subsequent report.

The all federal and state funds category reflects amounts from any source. The state general funds category reflects amounts from revenues raised through income, sales, and other broadbased state taxes. The all state funds category reflects amounts from any non-federal source; these include state general funds, other state funds (amounts from revenue sources that are restricted by law for particular government functions or activities, which for Medicaid includes provider taxes and local funds), and bonds (expenditures from the sale of bonds, generally for capital projects). Posted online April 4, 2018.

Source: MACPAC, 2017, analysis of state expenditure reports from the National Association of State Budget Officers, http://nasbo.org/mainsite/reports-data/state-expenditure-report/state-expenditure-archives.

1Medicaid’s share is estimated because spending for the program cannot be precisely isolated in the data on combined state and local spending from the U.S. Census Bureau’s Survey of Government Finances (SGF), for which SFY 2012 information is the most recent. The 17 percent share is a high estimate obtained by summing two SGF categories that are not limited to amounts paid by Medicaid: public welfare vendor payments (12 percent) and hospitals (5 percent). The public welfare vendor payments category reflects payments made directly to private purveyors for medical care, burials, and other commodities and services provided under welfare programs. Among other items, the hospitals category includes services provided directly by the government through its own hospitals and health agencies, which may be paid in part through disproportionate share hospital (DSH) and other Medicaid amounts.