In 2014, states contracted with 600 comprehensive Medicaid managed care plans (CMS 2014). These plans ranged from organizations that serve a few thousand Medicaid enrollees in a single county to subsidiaries of national plans that enroll hundreds of thousands of Medicaid beneficiaries in a given state and millions of enrollees across the country.

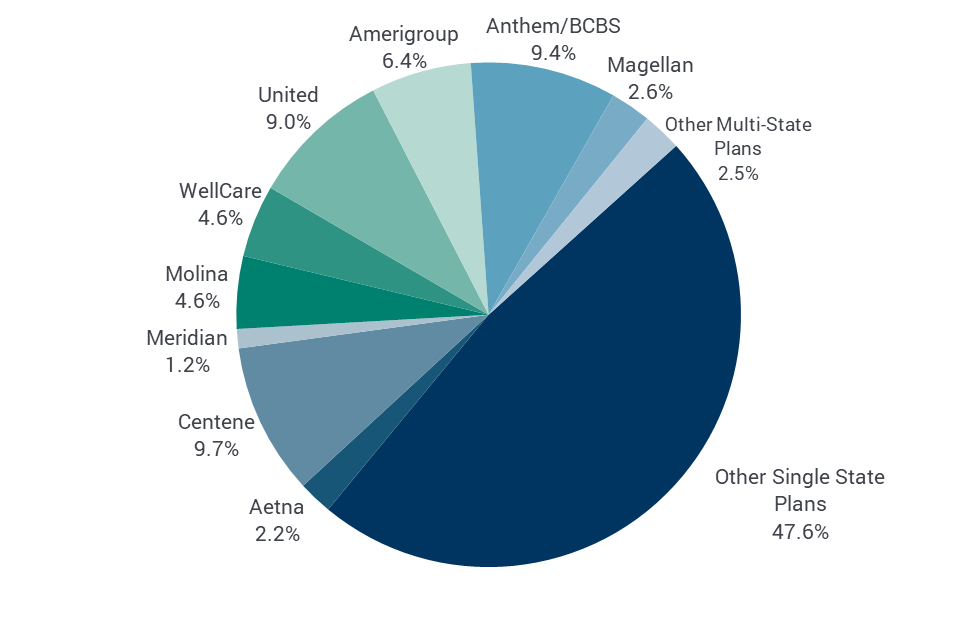

Over half (52.4 percent) of Medicaid enrollees in comprehensive risk-based Medicaid managed care in 2014 were in national plans that operated in multiple states; approximately 48 percent of enrollees in comprehensive risk-based managed care were in plans that operated within a single state or region within a state. As shown in Figure 1, these 15 national firms in 2014 included companies active in the commercial insurance market such as Blue Cross Blue Shield (BCBS) and United Healthcare, as well as firms that have historically focused on the Medicaid market, such as Molina and Centene. The largest five Medicaid MCOs (Centene, Anthem, United, Amerigroup, and WellCare) enrolled 39 percent of all Medicaid managed care members.

Figure 1: Medicaid Managed Care Enrollment Market Share by Firm, 2014

Notes: Other Multi-State Plans includes Kaiser Permanente, Cigna, BMC Health Net, Humana, IASIS Healthcare, and MedStar Health. Individually, each of these firms account for less than 1 percent of the total MCO enrollees. BCBS is Blue Cross/Blue Shield.

Sources: MACPAC analysis of CMS 2014 Medicaid Managed Care Enrollment Report as of May 2016 and Kaiser’s Medicaid Managed Care Market Tracker, Medicaid MCOs and their parent firms as of March 2016.

Federal rules allow states to contract with both for-profit and not-for-profit health plans, although states themselves can choose to contract with only certain types of health plans. Three common types of Medicaid health plans include:

- Provider-sponsored plans that are typically based around providers such as safety-net hospitals or community health centers that tend to have a history of serving low-income populations. Medicaid is an important payer for many of these plans. Provider-sponsored plans can be for-profit or not-for-profit.

- Government-sponsored plans that are created by state and local governments to provide managed care to Medicaid enrollees in a given geographical area. Established as independent health authorities to provide more local control and administration, these plans may constitute a single delivery system for all Medicaid enrollees in the jurisdiction or they may coexist and compete with other health plans in the area.

- Commercial or publicly-traded plans that are for-profit and privately owned by shareholders, equity firms, or other companies. These plans can serve Medicaid exclusively or also participate in the commercial and Medicare markets.

The Medicaid market is served by a large number of plans that focus on government programs and are often sponsored by safety-net providers or public-private partnerships. Prior to 1997, federal rules required comprehensive risk-based Medicaid managed care plans to have at least 25 percent of their enrollment in the private insurance market. The Balanced Budget Act of 1997 (BBA, P.L. 105- 33) eliminated this 75/25 rule, which made it easier for plans to participate in Medicaid, contributed to a rise of Medicaid-dominant plans and a decrease in participation by commercial health plans (Felt-Lisk et al. 2001). A 2011 study of Medicaid health plans found that of the 225 comprehensive Medicaid health plans that enrolled at least 5,000 members, 134 plans were Medicaid-dominant; that is, Medicaid enrollees accounted for at least 75 percent of their total enrollment and in many cases almost 100 percent of their total enrollment (McCue and Bailit 2011).

The creation of exchange coverage under the Patient Protection and Affordable Care Act (ACA, P.L. 111-148, as amended) created new market dynamics beginning in 2014. This includes opportunities for Medicaid-focused plans to expand into the individual market and for commercial plans participating in the exchanges to consider participating in Medicaid in order to capture family members of current enrollees and retain enrollees who transition between Medicaid and the exchanges. A study by the Association for Community Affiliated Plans found that in 2016, 41 percent of insurers offering exchange coverage also offered a Medicaid managed care plan in the same state (ACAP 2016).