Individuals who are dually eligible for Medicaid and Medicare typically start out as eligible for one of the two programs and then obtain eligibility for the other program. For example, Medicaid enrollees may turn 65 years old and become eligible for Medicare. Dually eligible beneficiaries become eligible for Medicaid under various pathways, some of which are mandatory for states and others that are optional. Mandatory pathways include:

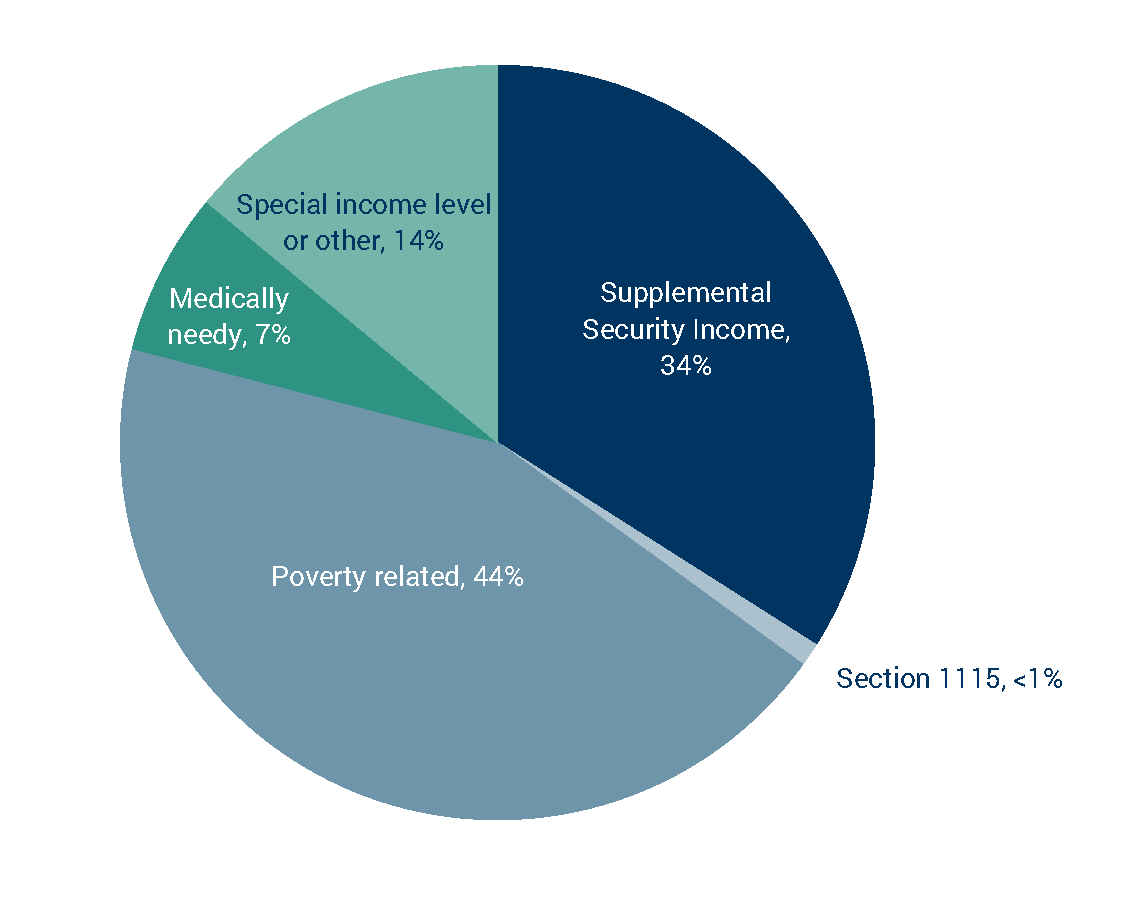

- Supplemental Security Income (SSI). Slightly more than one-third (37 percent) of dually eligible beneficiaries qualify for Medicaid under the mandatory SSI pathway based on their receipt of federal SSI benefits. SSI is available to individuals with limited incomes (up to about 75 percent of the federal poverty level) and assets ($2,000 for an individual and $3,000 for a couple), who are under age 65 and disabled, or who are age 65 and older.

- Medicare Savings Programs (MSPs). MSPs use Medicaid funds to provide assistance with Medicare premiums and cost sharing for low-income Medicare beneficiaries who have difficulty affording them. Dually eligible beneficiaries who only qualify for Medicaid through the MSPs are not eligible for full Medicaid benefits and are known as partial benefit dually eligible beneficiaries. Slightly more than one quarter (29 percent) of dually eligible beneficiaries are only eligible for partial Medicaid benefits.

Additional optional eligibility pathways are available to people with disabilities and individuals age 65 and older including:

- Poverty-related pathways. States may opt to cover individuals with disabilities and those age 65 and older with incomes up to 100 percent of the federal poverty level (FPL).

- Medically needy pathway. Under this option, individuals whose incomes are too high to qualify for Medicaid can spend down to a state-specified medically needy income level by incurring medical expenses.

- Special income level and other pathways. These pathways require an institutional level of care. States may cover individuals with incomes up to 300 percent of the SSI benefit rate (about 225 percent FPL for an individual) who are receiving long term-services and supports in an institution. States may also extend eligibility to individuals who use home- and community-based waiver services as an alternative to institutionalization.

- Section 1115 waiver pathway. States can provide additional eligibility pathways through a waiver of federal law under Section 1115 of the Social Security Act.

Share of Dually Eligible Population by Medicaid Eligibility Pathways

Source: The Medicaid and CHIP Payment and Access Commission (MACPAC) and the Medicare Payment Advisory Commission (MedPAC), 2022. Exhibit 10: Medicaid eligibility pathways, CY 2019 in Data Book: Beneficiaries dually eligible for Medicare and Medicaid. Washington, DC: MedPAC and MACPAC.

For most eligibility pathways that apply to people with disabilities and people who are age 65 and older, states may choose to be less restrictive when counting income and resources, in order to expand eligibility. States may also opt to use more restrictive criteria by applying the more restrictive rules in effect on January 1, 1972. States choosing this option are referred to as Section 209(b) states for the section of the law (P.L. 92-603) that created the option.

For more information about Medicaid eligibility pathways for the individuals over age 65 and those with disabilities, see the fact sheet on Federal requirements and state options: Eligibility.

To see each state’s Medicaid income eligibility levels for individuals age 65 and older and people with disabilities, including Section 209(b) states, go to MACStats Exhibit 37.